GOLDEN, Colo., April 15, 2020 (GLOBE NEWSWIRE) -- Golden Minerals Company (NYSE American and TSX: AUMN) (“Golden Minerals”, “Golden” or “the Company”) is pleased to announce results from a Preliminary Economic Assessment (“PEA”) completed for its Rodeo open pit gold project located in Durango State, Mexico.

PEA Financial and Economic Highlights

Independent engineering firm Mineral Resources Engineering has prepared the PEA for the Company in accordance with Canadian National Instrument 43-101 “Standards of Disclosure of Mineral Projects” (“NI 43-101”). The resource used for this PEA was developed in accordance with Canadian NI 43-101 by the independent engineering firm Tetra Tech (report dated January 26, 2017: NI 43-101 Technical Report; Mineral Resource Estimate; Rodeo Project; Rodeo, Durango, Mexico). The PEA assumes prices of $1,622/oz gold and $14.38/oz silver. Preliminary results of the economic analysis are shown in after-tax U.S. Dollars as highlighted below. The complete PEA will be published on SEDAR within 45 days of this press release.

- After-tax net present value (“NPV”): (US)$22.5 million at an 8% discount rate

- Life of Mine (“LOM”) after-tax free cash flow: $24.9 million

- Pre-production development time: 1 quarter (3 months)

- LOM: 9 quarters

- Total pre-production costs, including capital and contingency: $1.5 million

- After-tax payback period: during the first production quarter

- LOM contained production: 41 Koz Au; 118 Koz Ag

- LOM payable production : 34 Koz Au ; 89 Koz Ag

- LOM average gold grade: 3.31 grams per tonne (“g/t”); average silver grade: 9.65 g/t

- Cash cost per Au oz, net of by-product credits: $798

- All-in sustaining cash cost per Au oz, net of by-product credits: $843

Warren M. Rehn, Golden’s President and Chief Executive Officer, notes, “We’ve purposely held onto the Rodeo project for several years, waiting for the right opportunity to monetize this asset by utilizing our existing infrastructure to process its gold and silver. With the Hecla lease coming to an end this year, we intend to bring Rodeo into production in 2021. This PEA indicates that Rodeo presents us with the opportunity to realize over $24 million of after-tax cash flow in two years’ time with very low capital requirements, which will in turn support our work at Velardeña and other exploration projects.”

After-Tax Economic Results of the Project:

| Item | Total LOM ($millions) | Total LOM (per tonne) | |

| Gross Payable | $55.67 | $146.03 | |

| TCs, Freight, Ins, Etc. | ($1.05) | ($2.75) | |

| NSR | $54.63 | $143.28 | |

| Royalties | ($1.37) | ($3.58) | |

| Operating Costs | |||

| Mining | ($9.12) | ($23.91) | |

| Processing Costs | ($12.92) | ($33.90) | |

| G&A and Head Office | ($0.43) | ($1.14) | |

| Contingency | ($2.25) | ($5.89) | |

| Operating Margin | $28.54 | $74.86 | |

| Capital Cost | |||

| Mine Capital | ($0.54) | ($1.41) | |

| Pre-Production Costs | ($0.81) | ($2.14) | |

| Contingency | ($0.16) | ($0.42) | |

| Pre-Tax Cash Flow | $27.03 | $70.89 | |

| Pre-Tax NPV8% | $24.36 | ||

| Income Tax Provision | ($2.14) | ||

| After Tax Cash Flow | $24.89 | ||

| After-Tax NPV8% | $22.46 |

Mine Planning

The strip ratio for the project is 1.7:1, and the processing plant’s daily throughput is estimated to be 480 tpd (based on a 350-day operating year). The excavation of the Rodeo resource will be completed in three push backs starting in the highest-grade material closest to the surface.

The mining excavation will be completed using a regional contractor. Golden Minerals will supply overall project management and engineering, which includes in-pit technicians that will determine whether material is suitable for process or placement on the waste dump. The Golden Minerals lab, located in Velardeña, Durango will be used for the project’s assaying requirements. Golden Minerals’ oxide plant at Velardeña, which will be used to process the mined material from Rodeo, is a typical agitated leach plant that can handle up to 550-tpd of throughput. The plant is equipped with a modern doré refinery, and the attached tailings facility recently underwent a major expansion.

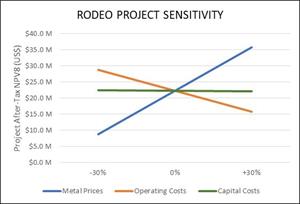

Sensitivity Tables

The after-tax economic results of the project using a +/- 30% sensitivity are as follows:

| Project After-Tax NPV8 | -30 Percent (Decrease) | 0 Percent (Model) | +30 Percent (Increase) | |

| Metal Prices | $8.86 M | $22.30 M | $35.74 M | |

| Operating Costs | $28.84 M | $22.30 M | $15.75 M | |

| Capital Costs | $22.49 M | $22.30 M | $22.11 M |

PEA Information and Cautionary Note Regarding Inferred Resources

The discounted cash flows in the PEA are provided after-tax and are prepared in compliance with NI 43-101 of the Canadian Securities Administrators. The mine plan evaluated in the PEA is preliminary in nature and additional technical studies will need to be completed in order to fully assess its viability. There is no certainty that the economic results described in the PEA will be realized. In addition, we may determine to proceed with a production decision without completion of customary feasibility studies demonstrating the economic viability of the Rodeo project. A mine production decision that is made without a feasibility study carries additional potential risks which include, but are not limited to, (i) increased uncertainty as to projected initial and sustaining capital costs and operating costs, rates of production and average grades, and (ii) the inclusion of Inferred Mineral Resources, as defined by NI 43-101 that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be converted to a Mineral Reserve, as defined by NI 43-101. Mine design and mining schedules, metallurgical flow sheets and process plant designs may require additional detailed work and economic analysis and internal studies to ensure satisfactory operational conditions and decisions regarding future targeted production.

No mineral reserves have been estimated for the project. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Cautionary Note to United States Investors Regarding Estimates of Indicated and Inferred Mineral Resources

This press release uses the terms "mineral resources", "indicated mineral resources" and "inferred mineral resources" which are defined in and required to be disclosed by NI 43-101. We advise U.S. investors that these terms are not recognized under the SEC Industry Guide 7. Accordingly, the disclosures regarding mineralization in this news release may not be comparable to similar information disclosed by Golden Minerals in the reports it files with the SEC. The estimation of measured resources and indicated resources involves greater uncertainty as to their existence and economic feasibility than the estimation of proven and probable reserves. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. US investors are cautioned not to assume that any or all of Mineral Resources are economically or legally mineable or that these Mineral Resources will ever be converted into Mineral Reserves. In addition, the SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit amounts. U.S. investors are urged to consider closely the disclosure in our Form 10-K and other SEC filings.

Review by Qualified Person and Quality Control

Mr. David Drips is the independent Qualified Person from Mineral Resources Engineering who authored the technical report that will be filed on SEDAR within 45 days of this news release. Mr. Drips has reviewed and approved the information presented in this news release that derives from the PEA study.

Non-GAAP Financial Measures

Cash costs per payable gold ounce, net of by-product credits, and all-in sustainable costs per payable gold ounce, net of by-product credits, are non-GAAP financial measures calculated by the Company as set forth below and may not be comparable to similar measures reported by other companies.

Cash costs per payable gold ounce, net of by-product credits, include all direct and indirect costs associated with the physical activities that would generate concentrate and doré products for sale to customers, including mining to gain access to mineralized materials, mining of mineralized materials and waste, milling, third-party related treatment, refining and transportation costs, on-site administrative costs and royalties. Cash costs do not include depreciation, depletion, amortization, exploration expenditures, reclamation and remediation costs, sustaining capital, financing costs, income taxes, or corporate general and administrative costs not directly or indirectly related to the Rodeo project. By-product credits include revenues from silver contained in the products sold to customers during the period. Cash costs, after by-product credits, are divided by the number of payable gold ounces generated by the plant for the period to arrive at cash costs, after by-product credits, per payable ounce of gold. All-in sustainable costs per payable gold ounce, net of by-product credits, begins with cash costs per payable gold ounce, net of by-product credits, and also includes pre and post-production capital and sustaining capital.

Cost of sales is the most comparable financial measure, calculated in accordance with GAAP, to cash costs. As compared to cash costs, cost of sales includes adjustments for changes in inventory and excludes net revenue from by-products and third-party related treatment, refining and transportation costs, which are reported as part of revenue in accordance with GAAP.

About Golden Minerals

Golden Minerals is a Delaware corporation based in Golden, Colorado. The Company is primarily focused on advancing its Velardeña Properties in Mexico and its El Quevar silver property in Argentina, as well as acquiring and advancing mining properties in Mexico and Nevada.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities legislation, including statements the Rodeo PEA results (including cost estimates, assumption of commodity prices, development timing, expected cash flows and life of mine and production expectations); future activities at Rodeo, and the possibility of future production from Rodeo; mining excavation and assaying plans; and estimates of mineral resources for the Rodeo project. These statements are subject to risks and uncertainties, including: the reasonability of the economic assumptions at the basis of the results of the Rodeo PEA and technical report; our ability to timely obtain the necessary permits for commencement of production at Rodeo; changes in interpretations of geological, geostatistical, metallurgical, mining or processing information and interpretations of the information resulting from future exploration, analysis or mining and processing experience; declines in general economic conditions; fluctuations in exchange rates and changes in political conditions, in tax, royalty, environmental and other laws in Mexico; new information from drilling programs or other exploration or analysis; unexpected variations in mineral grades, types and metallurgy; fluctuations in commodity prices; and failure of mined material or veins mined to meet expectations. Additional risks relating to Golden Minerals may be found in the periodic and current reports filed with the Securities and Exchange Commission by Golden Minerals, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

For additional information please visit http://www.goldenminerals.com/ or contact:

Golden Minerals Company

Karen Winkler, Director of Investor Relations

(303) 839?5060

SOURCE: Golden Minerals Company

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/45b37758-e596-4889-8ba1-c4adbd20fa3f